Bailieston

The Bailieston project targets epizonal gold and antimony mineralisation within the Melbourne Zone, which is characterised by gold and antimony mineralisation and hosts several successful modern gold mines including the world-class Fosterville gold mine owned by Agnico Eagle and the Costerfield Mine owned by Mandalay Resources.

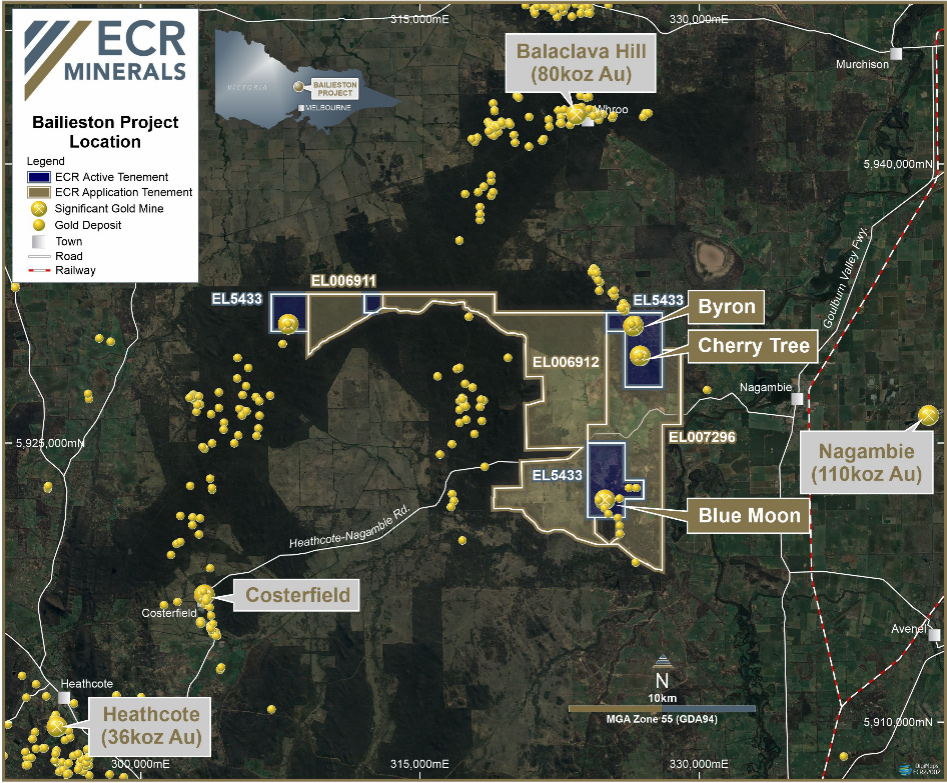

ECR Minerals currently holds a total of 142 km2 of exploration ground across four projects (EL5433, EL006911, EL006912 and EL007296).

Bailieston is located approximately 150km north of the Victorian state capital, Melbourne, with good road access. The project is located geologically within the orogenic Lachlan Fold Belt (LFB). The LFB is subdivided into geological zones based on distinct geological and metallurgical characteristics.

The project area consists of Siluro Devonian sediments intruded by Devonian granite stocks. Mineralisation is hosted by quartz veins or stockwork structures, typically associated with anticlinal folding within the sediments.

The Bailieston project contains the historical prospects known as HR3 (Byron-Maori), HR4 (Cherry Tree), Blue Moon, Black Cat and Pontings, with all of those having a modest historical production history. The area has also seen more recent production where around 20,000 ozs of gold were mined in the Bailieston Open Pit and around 110,000 ozs at the Nagambie Mine by Perseverance Corporation Ltd. in the 1990s. Current mining for antimony and gold is taking place 50km to the west of Bailieston at the Costerfield Mine by Alkane Resources (previously Mandalay Resources).

ECR’s latest exploration campaigns have focussed on drilling the Maori Anticline at HR3 and the Blue Moon prospect. Some of the best results include 4m @ 9.01 g/t Au (BH3DD043) from HR3 and 6.35m @ 4.56 g/t Au (BBMDD010) from Blue Moon.

But far more significantly we took the decision to re-analyse the core from our previous drilling in 2020-21 at the HR3 prospect at Bailieston for antimony. The Costerfield-Bailieston-Nagambie district is noted for economic veins of antimony and elevated antimony had been observed from previous pXRF analysis of the drill core. Antimony is classified as a critical mineral by the Australian Government and by many other major economies and, in the past year, has seen a 200% price increase.

As part of ECR’s drilling programme in 2021-2022 at Bailieston, all diamond drill core underwent regular analysis using a handheld pXRF unit. The data was subsequently analysed for antimony concentrations exceeding 2,000 ppm Sb. 44 samples were chosen and forwarded to OSLS Laboratory in Bendigo for comprehensive multi-element analysis (ME-ICP). Samples returning Sb higher than 4,000 ppm are tested for higher Sb concentrations by XRF method.

The best sample returned an antimony result of 0.3m @ 32% Sb while a further 11 samples returned anomalous results greater than 0.1% Sb.

A four-hole diamond drilling programme, which was completed in the first half of 2025, intersected gold and antimony mineralisation.

Hole BH3DD044 delivered promising results, intersecting a 1.6m mineralised zone from 133.0m, including 0.2m @ 3.86 g/t Au and 1.41% Sb from 133.5m, yielding a gold equivalent grade (AuEq) of 7.62 g/t at 133.5m (based on A$3,500/oz gold and A$30,000/t antimony prices), and 0.3m @ 3.09 g/t Au from 133.7m, with visual confirmation of stibnite (antimony sulphide) throughout this interval. Additionally, a shallower intercept in BH3DD044 returned 0.2m @ 0.92 g/t Au from 61.3m.

Hole BH3DD046 intersected 0.15m @ 0.84 g/t Au and 1.62% Sb from 135.2m.